About G. Halsey Wickser, Loan Agent

Table of ContentsThe Facts About G. Halsey Wickser, Loan Agent RevealedThe Main Principles Of G. Halsey Wickser, Loan Agent Fascination About G. Halsey Wickser, Loan AgentFacts About G. Halsey Wickser, Loan Agent RevealedSome Known Facts About G. Halsey Wickser, Loan Agent.

The Support from a home loan broker doesn't end when your home loan is secured. They give continuous support, aiding you with any type of questions or concerns that occur throughout the life of your financing - Mortgage Broker Glendale CA. This follow-up assistance makes sure that you remain pleased with your mortgage and can make educated decisions if your monetary situation modificationsDue to the fact that they deal with several lending institutions, brokers can find a financing product that fits your unique monetary scenario, also if you have been refused by a financial institution. This flexibility can be the secret to opening your imagine homeownership. Choosing to collaborate with a home mortgage expert can transform your home-buying trip, making it smoother, quicker, and more financially advantageous.

Discovering the ideal home for on your own and determining your spending plan can be exceptionally stressful, time, and money-consuming - mortgage broker in california. It asks a whole lot from you, diminishing your power as this job can be a task. (https://kitsu.app/users/1536498) A person who functions as an intermediary between a debtor a person looking for a home loan or mortgage and a lender generally a financial institution or lending institution

Getting The G. Halsey Wickser, Loan Agent To Work

Their high level of experience to the table, which can be critical in aiding you make notified choices and inevitably achieve successful home financing. With rate of interest varying and the ever-evolving market, having someone totally tuned in to its ongoings would certainly make your mortgage-seeking procedure a lot easier, easing you from navigating the battles of filling up out paperwork and performing lots of research study.

This lets them supply professional guidance on the most effective time to secure a mortgage. Because of their experience, they also have developed links with a large network of loan providers, ranging from significant financial institutions to customized mortgage carriers. This extensive network allows them to give property buyers with various home mortgage alternatives. They can utilize their connections to locate the most effective lending institutions for their customers.

With their market understanding and capacity to negotiate efficiently, home loan brokers play a crucial role in securing the very best home mortgage bargains for their clients. By maintaining connections with a varied network of lenders, home loan brokers gain accessibility to a number of home loan alternatives. Their increased experience, described above, can supply vital details.

A Biased View of G. Halsey Wickser, Loan Agent

They have the skills and strategies to convince loan providers to offer better terms. This might include reduced rate of interest rates, lowered closing expenses, or even extra versatile repayment timetables (california loan officer). A well-prepared mortgage broker can offer your application and financial account in a method that allures to loan providers, boosting your chances of an effective negotiation

This advantage is frequently a pleasant shock for several property buyers, as it permits them to take advantage of the know-how and resources of a home loan broker without stressing over sustaining additional expenditures. When a customer safeguards a mortgage via a broker, the lender compensates the broker with a payment. This commission is a portion of the lending amount and is often based on aspects such as the passion rate and the type of finance.

Mortgage brokers master recognizing these distinctions and collaborating with lending institutions to find a home loan that suits each borrower's particular requirements. This personalized method can make all the distinction in your home-buying trip. By functioning carefully with you, your home loan broker can guarantee that your car loan conditions align with your economic goals and capabilities.

G. Halsey Wickser, Loan Agent - Questions

Customized mortgage options are the key to a successful and sustainable homeownership experience, and home mortgage brokers are the professionals that can make it occur. Hiring a home loan broker to function alongside you may cause rapid finance approvals. By using their proficiency in this area, brokers can help you prevent possible challenges that typically create hold-ups in car loan authorization, bring about a quicker and more efficient path to protecting your home funding.

When it comes to buying a home, browsing the globe of home mortgages can be overwhelming. Home mortgage brokers act as intermediaries between you and possible lending institutions, aiding you locate the ideal home loan offer tailored to your specific situation.

Brokers are skilled in the intricacies of the mortgage sector and can use useful insights that can help you make educated choices. Instead of being limited to the home mortgage items provided by a single lending institution, home mortgage brokers have accessibility to a broad network of lenders. This means they can look around in your place to locate the most effective funding options available, possibly saving you money and time.

This access to multiple lending institutions provides you a competitive benefit when it concerns safeguarding a positive mortgage. Searching for the appropriate home loan can be a taxing process. By functioning with a home mortgage broker, you can conserve time and initiative by letting them handle the research study and paperwork entailed in finding and safeguarding a lending.

The Of G. Halsey Wickser, Loan Agent

Unlike a small business loan policeman that may be managing numerous clients, a home loan broker can give you with individualized service customized to your specific demands. They can make the effort to recognize your monetary scenario and objectives, providing tailored remedies that straighten with your specific requirements. Home loan brokers are skilled negotiators who can assist you protect the very best feasible terms on your loan.

Anna Chlumsky Then & Now!

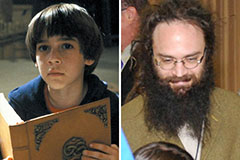

Anna Chlumsky Then & Now! Barret Oliver Then & Now!

Barret Oliver Then & Now! Judd Nelson Then & Now!

Judd Nelson Then & Now! Sam Woods Then & Now!

Sam Woods Then & Now! Bo Derek Then & Now!

Bo Derek Then & Now!